For investors and media only

Issued: London, UK

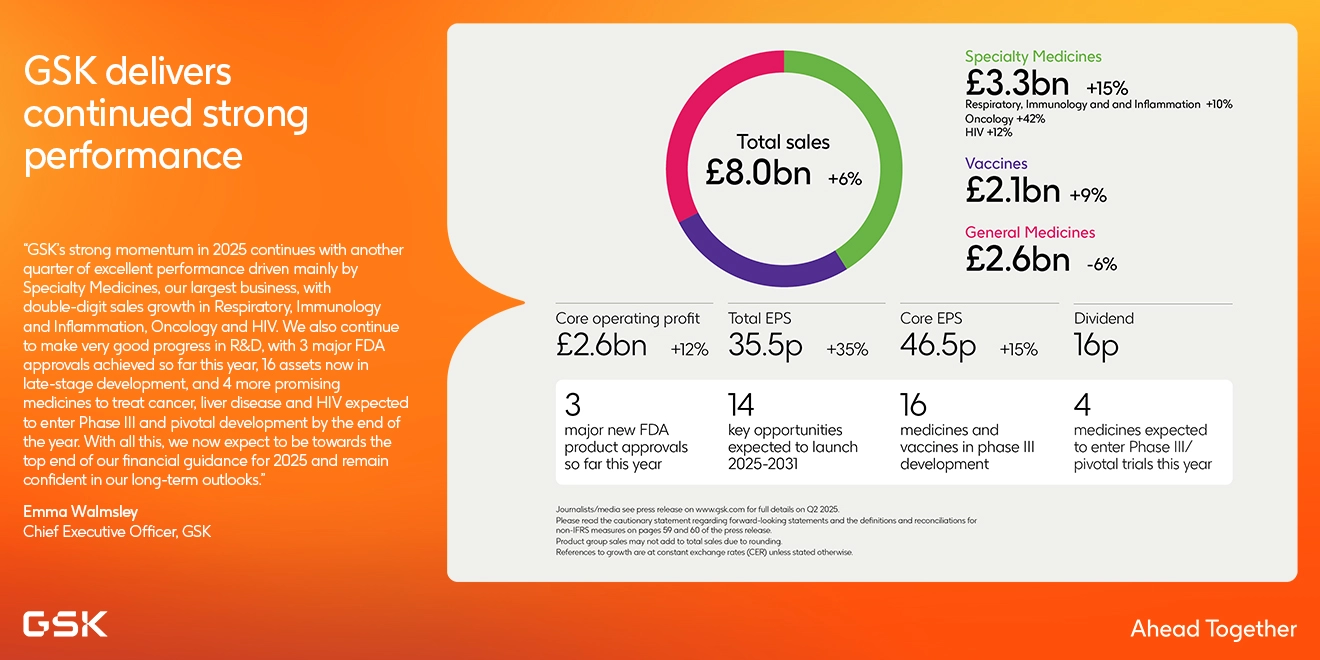

GSK delivers continued strong performance

Strong Specialty Medicines performance drives sales and core operating profit growth

- Total Q2 2025 sales £8.0 billion +1% AER; +6% CER

- Specialty Medicines sales £3.3 billion (+15%); Respiratory, Immunology & Inflammation £1.0 billion (+10%); Oncology £0.5 billion (+42%); HIV sales £1.9 billion (+12%)

- Vaccines sales £2.1 billion (+9%); Shingrix £0.9 billion (+6%); Meningitis vaccines £0.4 billion (+22%); and Arexvy £0.1 billion (+13%)

- General Medicines sales £2.6 billion (-6%); Trelegy £0.8 billion (+4%)

- Total operating profit +33% and Total EPS +35% driven by lower CCL charges partly offset by intangible asset impairments

- Core operating profit +12% and Core EPS +15% reflecting Specialty Medicines and Vaccines growth, higher royalty income and disciplined increased investment in R&D portfolio progression in Oncology and Vaccines

- Cash generated from operations of £2.4 billion with free cash flow of £1.1 billion

| Q2 2025 | Year to date | |||||

|---|---|---|---|---|---|---|

| £m | % AER | % CER | £m | % AER | % CER | |

| Turnover | 7,986 | 1 | 6 | 15,502 | 2 | 5 |

| Total operating profit | 2,023 | 23 | 33 | 4,239 | 35 | 41 |

| Total operating margin % | 25.3% | 4.5ppts | 5.4ppts | 27.3% | 6.8ppts | 7.2ppts |

| Total EPS | 35.5p | 23 | 35 | 75.3p | 38 | 45 |

| Core operating profit | 2,631 | 5 | 12 | 5,164 | 4 | 8 |

| Core operating margin % | 32.9% | 1.1ppts | 1.8ppts | 33.3% | 0.8ppts | 1.1ppts |

| Core EPS | 46.5p | 7 | 15 | 91.4p | 6 | 10 |

| Cash generated from operations | 2,433 | 47 | 3,734 | 35 | ||

Pipeline progress and investment delivering future growth opportunities:

5 major new product approvals expected in 2025:

- 3 US Approvals now received for Penmenvy meningitis vaccine, Blujepa first-in-class antibiotic treatment for uUTIs and Nucala, anti-IL5 biologic for COPD

- Blenrep (for multiple myeloma) approved in EU, Japan, UK, Canada and Switzerland. Constructive discussion ongoing with FDA with new PDUFA date set for 23 October 2025

- US regulatory decision on depemokimab (for asthma with type 2 inflammation, nasal polyps) expected in December 2025

Progress on 14 key opportunities expected to launch 2025-2031 each with PYS potential above £2 billion:

- Phase III PIVOT-PO study for tebipenem, a potential new antibiotic for cUTIs, stopped early for efficacy, with filing now planned by year end

- Phase III development programme for depemokimab COPD started with launch of ENDURA studies

- Pivotal/Phase III trial starts planned in H2 25 for: potential cancer treatments GSK'227 B7H3 ADC for ES-SCLC and GSK'981 IDRx-42 for 2L GIST; efimosfermin for treatment of MASH; and cabotegravir ultra long acting + rilpivirine (Q4M) for HIV treatment

Targeted business development continues strengthening RI&I and Oncology pipeline

- Acquisition of efimosfermin a potential best in class specialty medicine for steatotic liver disease from Boston Pharmaceuticals completed

- Agreements announced with Hengrui Pharma to develop up to 12 medicines in RI&I and Oncology, including licence for

potential best-in-class PDE3/4 inhibitor in clinical development for treatment of COPD

Continued commitment to shareholder returns

- Dividend declared of 16p for Q2 2025; 64p expected for full year 2025

- £822 million spent in H1 2025 as part of the £2 billion share buyback programme announced at FY 2024

Confident for delivery of 2025 guidance - towards top of range

- Increase towards the top end of range for turnover growth of 3% to 5%; Core operating profit growth of 6% to 8%; and

Core EPS growth of 6% to 8%

Emma Walmsley, Chief Executive Officer, GSK:

"GSK’s strong momentum in 2025 continues with another quarter of excellent performance driven mainly by Specialty Medicines, our largest business, with double-digit sales growth in Respiratory, Immunology & Inflammation, Oncology and HIV. We also continue to make very good progress in R&D, with 3 major FDA approvals achieved so far this year, 16 assets now in late-stage development, and 4 more promising medicines to treat cancer, liver disease and HIV expected to enter Phase III and pivotal development by the end of the year. With all this, we now expect to be towards the top end of our financial guidance for 2025 and remain confident in our long-term outlooks."

Assumptions and cautionary statement regarding forward-looking statements

The Group’s management believes that the assumptions outlined above are reasonable, and that the guidance, outlooks, and expectations described in this report are achievable based on those assumptions. However, given the forward-looking nature of these guidance, outlooks, and expectations, they are subject to greater uncertainty, including potential material impacts if the above assumptions are not realised, and other material impacts related to foreign exchange fluctuations, macro-economic activity, the impact of outbreaks, epidemics or pandemics, changes in legislation, regulation, government actions, including the impact of any potential tariffs or other restrictive trade policies on the Group's products, or intellectual property protection, product development and approvals, actions by our competitors, and other risks inherent to the industries in which we operate.

This document contains statements that are, or may be deemed to be, “forward-looking statements”. Forward-looking statements give the Group’s current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, dividend payments and financial results. Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation, the UK Listing Rules and the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority), the Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The reader should, however, consult any additional disclosures that the Group may make in any documents which it publishes and/or files with the SEC. All readers, wherever located, should take note of these disclosures. Accordingly, no assurance can be given that any particular expectation will be met and investors are cautioned not to place undue reliance on the forward-looking statements.

All guidance, outlooks and expectations should be read together with the guidance and outlooks, assumptions and cautionary statements in this Q2 2025 earnings release and in the Group's 2024 Annual Report on Form 20-F.

Forward-looking statements are subject to assumptions, inherent risks and uncertainties, many of which relate to factors that are beyond the Group’s control or precise estimate. The Group cautions investors that a number of important factors, including those in this document, could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Such factors include, but are not limited to, those discussed under Item 3.D ‘Risk Factors’ in the Group’s Annual Report on Form 20-F for 2024. Any forward-looking statements made by or on behalf of the Group speak only as of the date they are made and are based upon the knowledge and information available to the Directors on the date of this report.