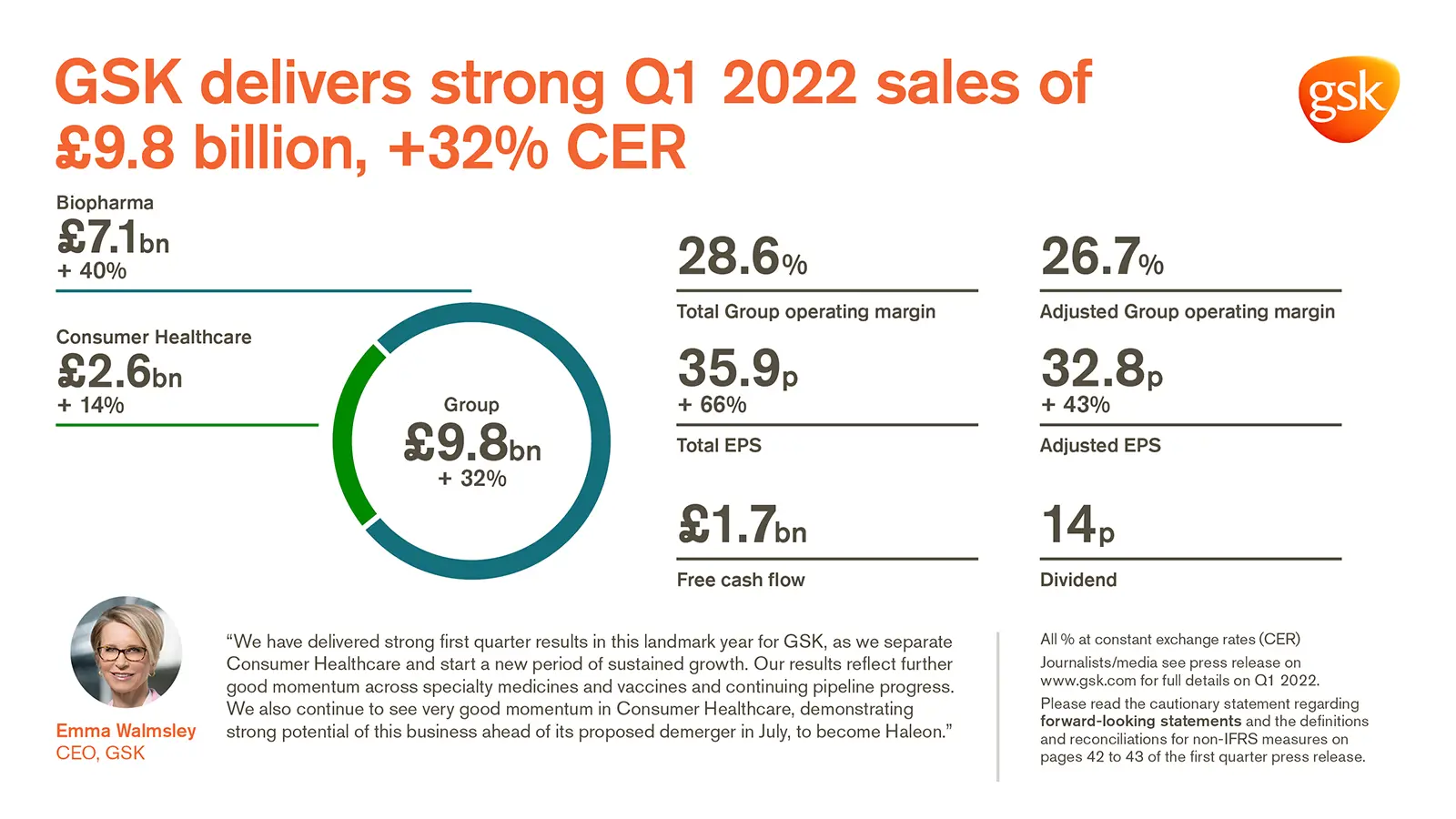

GSK delivers strong Q1 2022 sales of £9.8 billion, +32% AER, +32% CER; Total EPS 35.9p +67% AER, +66% CER and Adjusted EPS 32.8p +43% AER, +43% CER

For media and investors only

Issued: London, UK

Highlights

Strong sales growth across Biopharma and Consumer Healthcare

- Biopharma: £7.1 billion +40% AER, +40% CER;+14% AER, +15% CER excluding COVID-19 solutions

- Specialty Medicines £3.1 billion +98% AER, +97% CER; HIV +15% AER, +14% CER; Oncology +15% AER, +15% CER; Immuno-inflammation, respiratory and other +18% AER, +18% CER; COVID-19 solutions (Xevudy) sales £1.3 billion

- Vaccines £1.7 billion +36% AER, +36% CER; Shingrix £698 million >100% AER, >100% CER

- General Medicines £2.3 billion +2% AER, +3% CER

- Consumer Healthcare £2.6 billion +14% AER, +14% CER

- Sales growth also benefited from favourable comparison to Q1 2021

Continued R&D delivery and strengthening of pipeline

- US FDA regulatory approvals: Cabenuva treatment of virologically supressed adolescents living with HIV; Triumeq dispersible single tablet regimen for treatment of children with HIV

- US FDA regulatory submission acceptance of daprodustat for anaemia of chronic kidney disease (PDUFA action date 1 February 2023)

- Benlysta approved in China for adults with active lupus nephritis

- EU regulatory submission acceptance for Sanofi-GSK COVID-19 vaccine (Vidprevtyn) and Canadian regulatory approval for Medicago-GSK COVID-19 vaccine (Covifenz)

- Proposed acquisition of Sierra Oncology Inc. strengthens late-stage specialty pipeline. Momelotinib has potential to address significant unmet medical need of myelofibrosis patients with anaemia

- Multiple pipeline catalysts in next nine months, including phase III data read outs for the RSV Older Adults and meningitis (MenABCWY) vaccine candidates, Blenrep, Jemperli and otilimab, and phase IIb data for bepirovirsen

Cost discipline supports delivery of improved operating margin and Adjusted EPS of 32.8p

- Total Group operating margin 28.6%. Total EPS 35.9p +67% AER, +66% CER

- Adjusted Group operating margin 26.7%. Adjusted EPS 32.8p +43% AER, +43% CER. This included a contribution to growth from COVID-19 solutions of approximately +15% AER, +15% CER for Q1 2022

- Q1 2022 cash generated from operations £2.8 billion. Q1 2022 free cash flow £1.7 billion

On track to demerge and list Haleon, a new global leader in consumer healthcare, in July 2022

- New growth outlooks set out in Q1 2022, for annual organic revenue growth of 4-6% and sustainable moderate expansion of adjusted operating margin over medium term at CER

Reconfirming 2022 guidance

- GSK expected to deliver growth in 2022 sales of between 5% to 7% at CER and growth in 2022 Adjusted operating profit of between 12% to 14% at CER

- 2022 guidance excludes any contribution from COVID-19 solutions

- Dividend of 14p declared for Q1 2022

Emma Walmsley, Chief Executive Officer, GSK said:

“We have delivered strong first quarter results in this landmark year for GSK, as we separate Consumer Healthcare and start a new period of sustained growth. Our results reflect further good momentum across specialty medicines and vaccines, including the return to strong sales growth for Shingrix and continuing pipeline progress. We also continue to see very good momentum in Consumer Healthcare, demonstrating strong potential of this business ahead of its proposed demerger in July, to become Haleon.”

About GSK

GSK – one of the world’s leading research-based pharmaceutical and healthcare companies – is committed to improving the quality of human life by enabling people to do more, feel better and live longer. For further information please visit About us.

Assumptions and cautionary statement regarding forward-looking statements

The Group’s management believes that the assumptions outlined above are reasonable, and that the guidance, outlooks, ambitions and expectations described in this report are achievable based on those assumptions. However, given the forward-looking nature of these guidance, outlooks, ambitions and expectations, they are subject to greater uncertainty, including potential material impacts if the above assumptions are not realised, and other material impacts related to foreign exchange fluctuations, macro-economic activity, the impact of outbreaks, epidemics or pandemics, such as the COVID-19 pandemic and ongoing challenges and uncertainties posed by the COVID-19 pandemic for businesses and governments around the world, changes in legislation, regulation, government actions or intellectual property protection, product development and approvals, actions by our competitors, and other risks inherent to the industries in which we operate.

This document contains statements that are, or may be deemed to be, “forward-looking statements”. Forward-looking statements give the Group’s current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, dividend payments and financial results. Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation, the UK Listing Rules and the Disclosure and Transparency Rules of the Financial Conduct Authority), the Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The reader should, however, consult any additional disclosures that the Group may make in any documents which it publishes and/or files with the SEC. All readers, wherever located, should take note of these disclosures. Accordingly, no assurance can be given that any particular expectation will be met and investors are cautioned not to place undue reliance on the forward-looking statements.

All outlooks, ambitions considerations should be read together with; for Haleon the section “Assumptions and cautionary statement and regarding forward-looking statements” on page 163 of the Haleon Capital Markets Day all presentation slides dated 28 February 2022, and for GSK pages 5-7 of the Stock Exchange announcement relating to an update to investors dated 23 June 2021 and the Guidance, assumptions and cautionary statements of our Q2 2021 earnings release.

Forward-looking statements are subject to assumptions, inherent risks and uncertainties, many of which relate to factors that are beyond the Group’s control or precise estimate. The Group cautions investors that a number of important factors, including those in this document, could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Such factors include, but are not limited to, those discussed under Item 3.D ‘Risk Factors’ in

the Group’s Annual Report on Form 20-F for 2021 and any impacts of the COVID-19 pandemic. Any forward looking statements made by or on behalf of the Group speak only as of the date they are made and are based upon the knowledge and information available to the Directors on the date of this report.