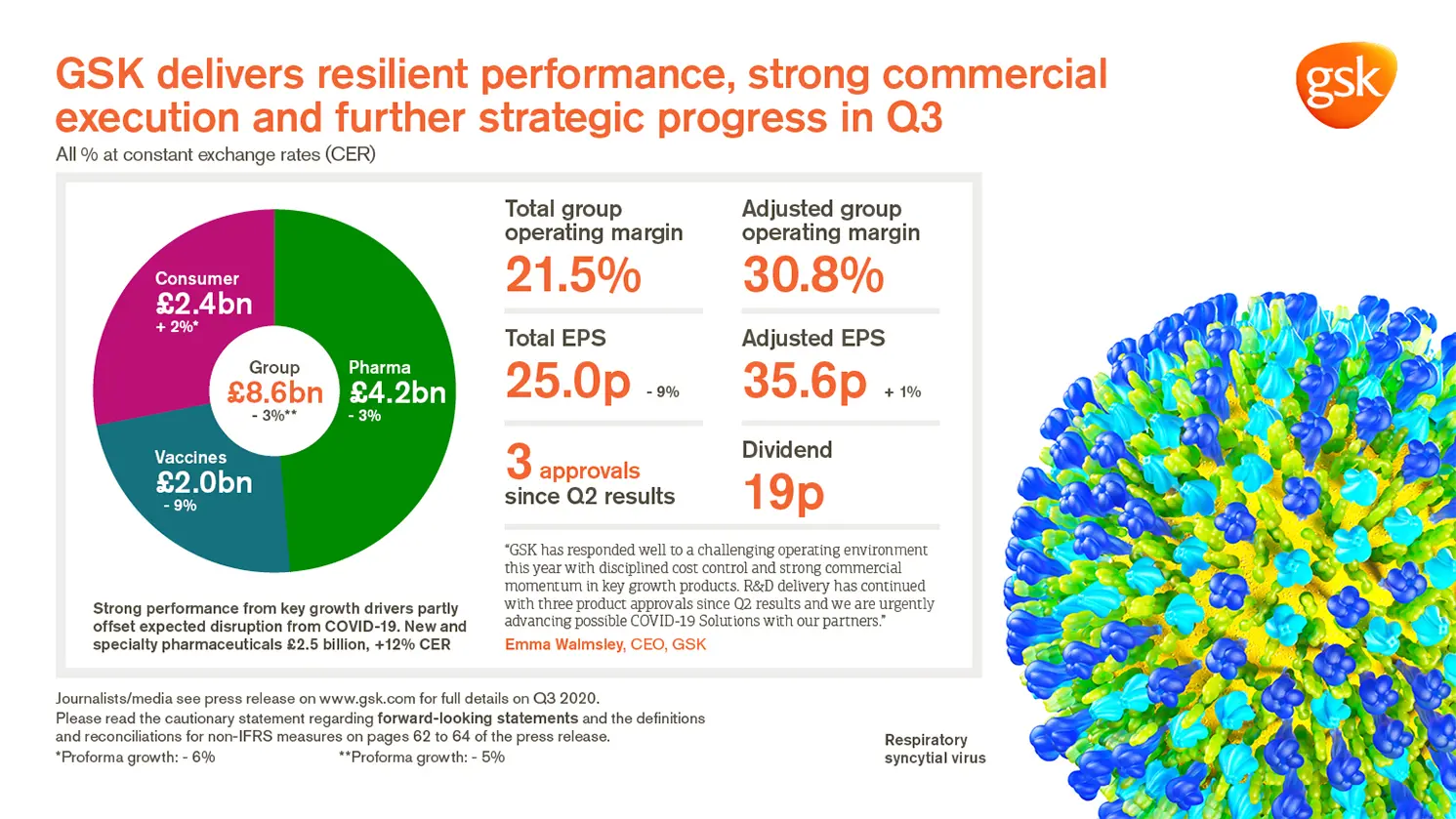

GSK delivers resilient performance, strong commercial execution and further strategic progress in Q3

Issued: London, UK

Financial and product highlights

-

Reported Group sales £8.6 billion, -8% AER, -3% CER (Pro-forma -5% CER*, -3% CER excluding divestments/brands under review). Pharmaceuticals £4.2 billion, -7% AER, -3% CER; Vaccines £2.0 billion, -12% AER, -9% CER; Consumer Healthcare £2.4 billion, -4% AER, +2% CER (Pro-forma -6% CER*). Strong performance from key growth drivers in respiratory, HIV, oncology and Consumer Healthcare partly offset by expected disruption from COVID-19

- Sales of new and specialty pharmaceuticals (excluding established products) £2.5 billion, +8% AER, +12% CER

- Respiratory sales £978 million, +21% AER, +26% CER. Trelegy sales £194 million +40% AER, +45% CER. Nucala sales £251 million, +24% AER, +29% CER

- HIV sales £1.2 billion, -4% AER, flat at CER; two-drug regimen sales £222 million, +87% AER, +94% CER

- Oncology sales £99 million, +55% AER, +58% CER

- Shingrix sales £374 million, -30% AER, -25% CER. US prescriptions rates returned to 2019 levels by quarter-end

- Total Group operating margin 21.5%. Adjusted Group operating margin 30.8%. SG&A decline reflecting ongoing and active focus on cost management. R&D costs down in quarter; expect 2020 full year R&D costs to rise mid-to-high single digits as we continue to invest in late-stage pipeline

- Total EPS 25.0p, -20% AER, -9% CER reflecting adverse changes on contingent consideration liabilities offset by asset disposals and improved operating performance

- Adjusted EPS 35.6p, -8% AER, +1% CER reflecting operating profit growth partly offset by higher effective tax rate and non-controlling interest allocation of Consumer Healthcare profits

- Q3 net cash flow from operations £0.9 billion. Free cash flow £(0.2) billion

- 19p dividend declared for the quarter

Guidance

- On track to deliver full year 2020 Adjusted EPS at the lower end of the -1% to -4% range at CER

Pipeline highlights

- Continued progress in biopharma pipeline with 3 approvals since Q2 results: FDA and EC approval of Blenrep as first anti-BCMA therapy for multiple myeloma; FDA approval of Trelegy for asthma; FDA approval of Nucala as first biologic treatment for Hypereosinophilic Syndrome (HES)

- Positive European CHMP opinions in HIV for cabotegravir and rilpivirine as long-acting regimen for HIV treatment and for Zejula as first-line monotherapy maintenance treatment in ovarian cancer

- Phase III trials to start in Q4 and Q1 2021 for RSV vaccines in maternal and older adults following positive Phase I/II data

- First participant vaccinated in Phase III clinical trial of 5-in-1 meningitis ABCWY vaccine candidate

COVID-19 Solutions update

- Phase I/II study of Sanofi-GSK adjuvanted recombinant protein-based vaccine candidate initiated. Phase III trial expected to start December 2020

- Supply agreements reached with US, EU, UK, Canada for Sanofi-GSK vaccine. Statement of Intent signed with COVAX facility to support successful and equitable access to COVID-19 vaccines worldwide

- Phase III study underway for Vir-GSK antibody (VIR-7831) for high-risk outpatients with COVID-19, with initial results potentially available by the end of 2020

Emma Walmsley, Chief Executive Officer, GSK said:

“GSK has responded well to a challenging operating environment this year with disciplined cost control and strong commercial momentum in key growth products including Nucala, Trelegy, Benlysta, 2 drug-HIV regimens, Zejula, Shingrix and our priority Consumer Healthcare brands. This, combined with improving vaccination rates this quarter, means we are on track to deliver within our earnings guidance range for 2020. In addition, we continue to make good progress on our preparations to separate the Group and create two new companies - in Biopharma and Consumer Health - which we believe will deliver options for sustainable growth and returns to shareholders.

“R&D delivery has continued with three product approvals since Q2 results and presentation of new clinical data to support the start of Phase III development for our very promising RSV vaccines. We are also urgently advancing possible COVID-19 Solutions with our partners, including clinical trials for antibody therapy VIR-7831 and three different adjuvanted vaccines. We expect to see data on all of these before the end of the year.”

About GSK

GSK – one of the world’s leading research-based pharmaceutical and healthcare companies – is committed to improving the quality of human life by enabling people to do more, feel better and live longer. For further information please visit www.gsk.com/about-us.

Assumptions and cautionary statement regarding forward-looking statements

The Group’s management believes that the assumptions outline in the 2019 Annual Report and relevant quarterly results announcements are reasonable, and that the aspirational targets described in such report or announcement are achievable based on those assumptions are reasonable, and that the aspirational targets described in such report or announcements are achievable based on those assumptions. However, given the longer term nature of these expectations and targets, they are subject to greater uncertainty, including potential material impacts if the above assumptions are not realised, and other material impacts related to foreign exchange fluctuations, macro-economic activity, the impact of outbreaks, epidemics or pandemics, such as the COVID-19 pandemic and ongoing challenges and uncertainties posed by the COVID-19 pandemic for businesses and governments around the world, changes in regulation, government actions or intellectual property protection, actions by our competitors, and other risks inherent to the industries in which we operate.

The Group’s reports filed with or furnished to the US Securities and Exchange Commission (SEC) and any other written information released, or oral statements made, to the public in the future by or on behalf of the Group, may contain forward-looking statements. Forward-looking statements give the Group’s current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, dividend payments and financial results. Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation, the UK Listing Rules and the Disclosure and Transparency Rules of the Financial Conduct Authority), the Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The reader should, however, consult any additional disclosures that the Group may make in any documents which it publishes and/or files with the SEC. All readers, wherever located, should take note of these disclosures. Accordingly, no assurance can be given that any particular expectation will be met and shareholders are cautioned not to place undue reliance on the forward-looking statements

Forward-looking statements are subject to assumptions, inherent risks and uncertainties, many of which relate to factors that are beyond the Group’s control or precise estimate. The Group cautions investors that a number of important factors, including those in this document, could cause actual results to differ materially from those expressed or implied in any forward-looking statement.

Such factors include, but are not limited to, those discussed under Item 3.D ‘Risk Factors’ in the Group’s Annual Report on Form 20-F for 2019 and any impacts of the COVID-19 pandemic. Any forward-looking statements made by or on behalf of the Group speak only as of the date they are made and are based upon the knowledge and information available to the Directors on the date of the relevant report or announcement.

A number of adjusted measures are used to report the performance of our business, which are non-IFRS measures. These measures are defined and reconciliations to the nearest IFRS measure are available in our 2019 Annual Report and in the relevant quarterly results announcement.

The information in this website does not constitute an offer to sell or an invitation to buy shares in GlaxoSmithKline plc or an invitation or inducement to engage in any other investment activities. Past performance cannot be relied upon as a guide to future performance. Nothing in this website should be construed as a profit forecast.