For media and investors only

Issued: London, UK

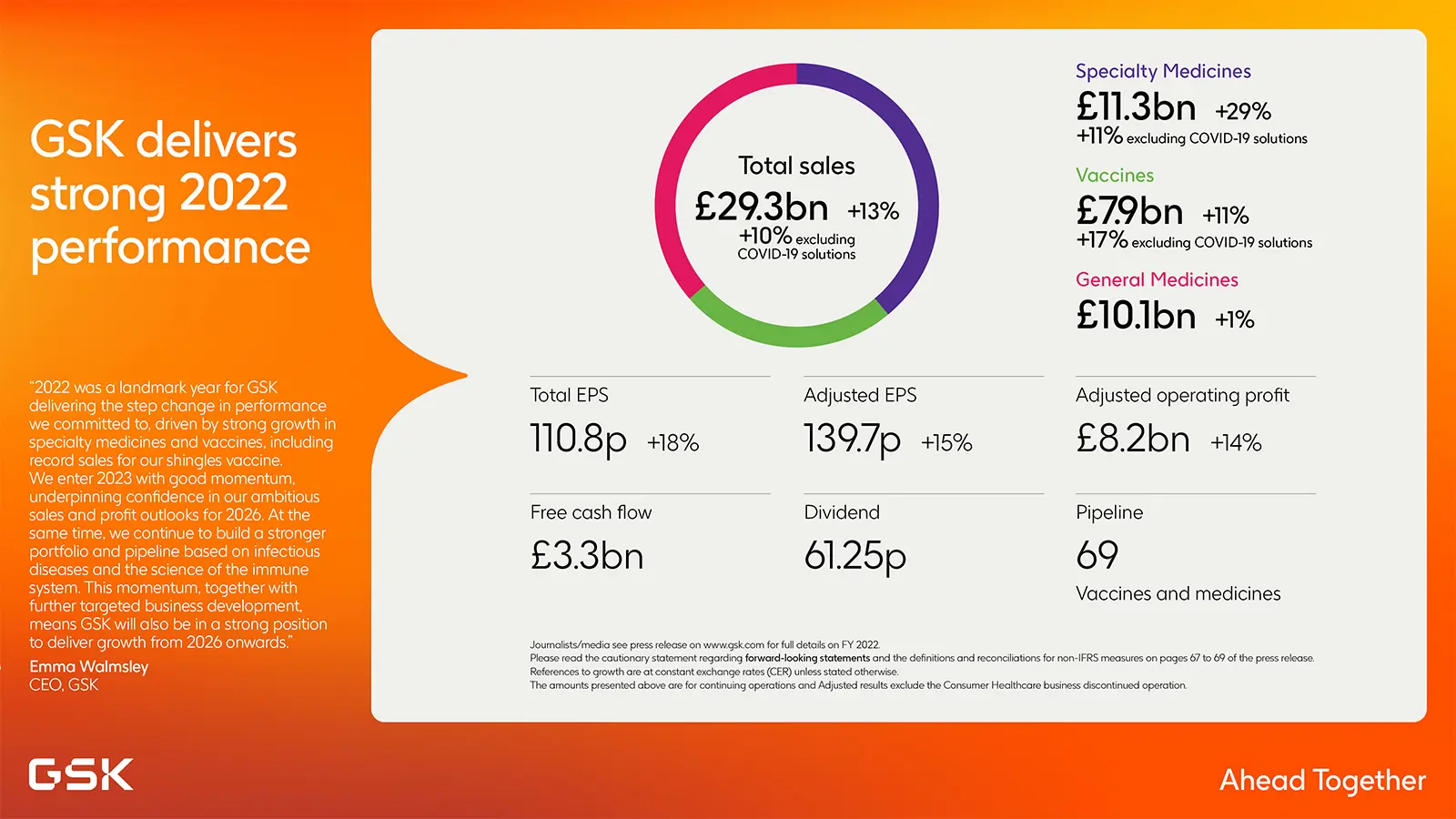

GSK delivers strong 2022 performance with full year sales of £29.3 billion +19% AER, +13% CER; Total EPS 371.4p >100% Adjusted EPS of 139.7p +27% AER, +15% CER from continuing operations

Highlights

Step change in commercial execution drives strong sales growth across Specialty Medicines and Vaccines

- Sales of £29.3 billion +19% AER, +13% CER. Sales +15% AER, +10% CER excluding COVID-19 solutions

- Specialty Medicines £11.3 billion +37% AER, +29% CER; HIV +20% AER, +12% CER; Oncology +23% AER, +17% CER; Immuno-inflammation and other specialty +29% AER +20% CER; COVID-19 solutions (Xevudy) sales £2.3 billion

- Vaccines £7.9 billion +17% AER, +11% CER; Shingrix £3 billion +72% AER, +60% CER

- General Medicines £10.1 billion +5% AER, +1% CER

Prioritised investment and cost discipline support strong growth in operating profit and EPS

- Total continuing operating margin 21.9%. Total EPS 371.4p > 100% primarily reflecting the gain from discontinued operations arising on the demerger of the Consumer Healthcare business. Total continuing EPS 110.8p +34% AER, +18% CER

- Adjusted operating margin 27.8%. Adjusted operating profit growth +26% AER, +14% CER. This included a decline in growth from COVID-19 solutions of approximately 3% AER and CER

- Adjusted EPS 139.7p +27% AER, +15% CER. This included a decline in growth from COVID-19 solutions of approximately 4% AER, 3% CER

- Full-year 2022 cash generated from operations attributable to continuing operations £7.9 billion. Full-year free cash flow £3.3 billion

R&D delivery and business development supports future growth

- Innovative pipeline of 69 vaccines and specialty medicines based on science of the immune system, with 18 in phase III/registration

- Potential best in class RSV older adults candidate vaccine filed in US, EU, Japan; Shingrix interim 10-year data presented at ID Week 2022; acquisition of Affinivax completed, including phase II next-generation vaccine for pneumococcal disease and use of innovative MAPs technology

- Continued progress in development of long-acting HIV treatments; positive phase II data on N6LS broadly-neutralising antibody presented at HIV Glasgow

- Pivotal phase III trials for gepotidacin antibiotic for uncomplicated UTIs stopped early for efficacy; positive phase IIb data for bepirovirsen, potential functional cure for chronic hepatitis B; exclusive licence agreement with Spero Therapeutics for tebipenem Hbr, late-stage antibiotic for complicated UTIs

- Expansion of depemokimab phase III programme with trials for long-acting IL-5 inhibitor in three additional eosinophil-driven diseases

- 4 approvals anticipated in 2023: RSV OA vaccine (US, EU, JP); Jemperli in 1L endometrial cancer (US); momelotinib in myelofibrosis (US) and daprodustat in chronic kidney disease (US, EU)

Confident in outlooks for turnover and Adjusted operating profit growth

- 2023 Turnover expected to increase between 6% to 8%; Adjusted operating profit expected to increase between 10% to 12%; EPS expected to increase between 12% to 15%

- 2023 Guidance at CER and excludes any contribution from COVID-19 solutions

- 13.75p dividend declared for the Q4 2022. No change to expected dividend from GSK of 56.5p/share for 2023

Emma Walmsley, Chief Executive Officer, GSK said:

“2022 was a landmark year for GSK delivering the step change in performance we committed to, driven by strong growth in specialty medicines and vaccines, including record sales for Shingrix. We enter 2023 with good momentum, underpinning confidence in our ambitious sales and profit outlooks for 2026. At the same time, we continue to build a stronger portfolio and pipeline based on infectious diseases and the science of the immune system, including our potential new RSV vaccine. This momentum, together with further targeted business development, means GSK will also be in a strong position to deliver growth from 2026 onwards.”

Assumptions and cautionary statement regarding forward-looking statements